If you use an area of your family home for work, you could claim GST on the home running costs proportionate to the percentage of the home office area to the house.

Calculate the percentage of the area

Work out the proportion of the area you use for work against the total area of your home. For instance, if you use 10% of your area for your business, your home office expense will be the total running cost of home multiplied by 10%.

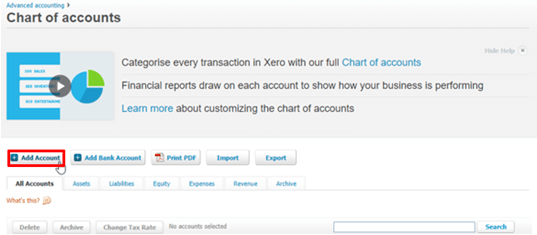

Create home office expenses account

Add a home office expenses account to your chart of accounts if you have not.

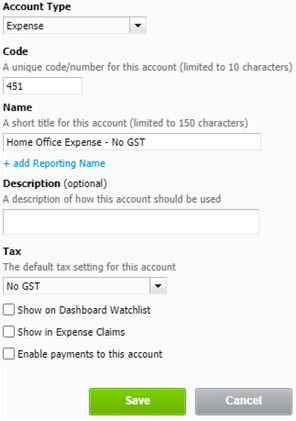

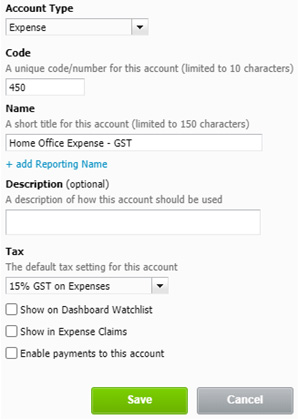

If you are not GST registered, you only need one account for home office expenses:

If you are GST registered, you need separate two accounts for GST claimable expenses and GST non-claimable expenses:

Expenses you usually can claim

GST

Rates

Electricity

Gas

Telephone

Internet

Insurance

No GST

Rent

Interest on Mortgage

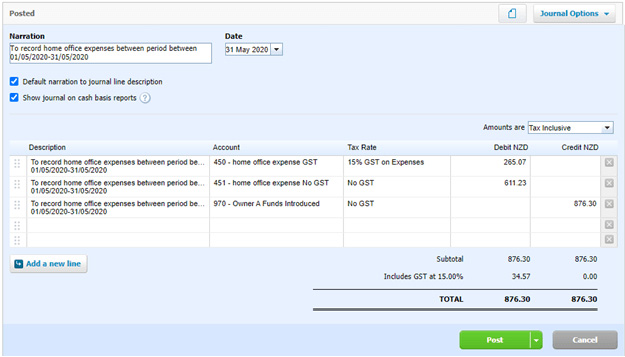

Create a manual journal and post it

You need to add a new journal to record home office expenses.

- Write a description of this journal, including percentages and the period in a narration.v

- Set the date (usually the last day of a GST period or the financial year) and the reference to the amounts to be tax inclusive.

- Code the total of Home office expenses (GST) and Home office expenses (No GST) in Debit.

- If you are not GST registered or record Home office expenses (No GST), make sure that you set the tax rate to No GST.

- Code Owner’s funds introduced with No GST tax rate to balance all amount of home office expenses in credit.

- Once you have completed the tasks above, finish by simply posting it.

You can find more information in the FAQs under Working from Home.